Travelling with children is certain to be an enriching experience for you all, making memories together as a family and broadening your children’s horizons. As amazing as it is, when on the road managing your money while travelling with children is a bit more complicated than when you are travelling as a couple. From accommodation and transportation to entertainment and meals, just about every decision you make has a cost implication.

Happily, there are things you can do to make your life easier. By taking the time to do some financial planning before you leave and considering some simple steps to manage your spending while you are traveling you are on your way to a smooth and stress-free journey.

Things to Consider Before You Go

Before you even book your tickets, you can do some things that will be a big help when you start your journey together.

Explore Traveling Off-Peak

If you are looking for bargains and you don’t mind less-than-ideal weather then travelling off-peak can lead to significant savings. In the off or even the shoulder seasons, your negotiating power is much greater than when you go at the peak.

Hotel prices are usually lower during off-peak seasons, and you are also more likely to find special offers. Likewise, attractions and activities tend to be less crowded (a definite plus for us!) This not only means a more relaxed experience but many attractions offer discounted or even free admission for children.

Additionally, travelling off-peak often means lower travel costs. Flights, trains, and buses may have more affordable prices during these times as demand is lower.

All this is a balancing act of course. Going off-peak does mean that the weather could be worse and from experience, we would say it doesn’t matter how much money you save; if your children are cold and wet you will all be miserable.

Avoiding Foreign Currency Transaction Charges and Earning Rewards for Spending

Banks love to hit you with fees for using your card when travelling. If you are away for a few weeks holiday then it can be annoying, but if you are away for a year then the cost can mount up.

Before you go, take a look for an account that offers free banking abroad. If you are in the UK, Martin’s Money Tips is always a great place to see the latest travel money offers. At the time of writing, the best UK deal seems to be Chase Bank with a really strong exchange rate, no fees to use your debit card abroad and 1% cash back on all your spending; however, this could change at any time so be sure to take a look around.

If you are looking for credit cards that offer cash back & points while travelling then there is very little on offer in the UK at the moment. For our American readers, there seems to be plenty! A good starting point is Nomadic Matt who has an excellent blog post about the best offers, and we are in awe of Travel Lemming who is an expert at making the most of sign-up bonuses!

If you are looking for broader tips on planning before you travel take a look at our Guide to Planning Travelling with Children where we dig a bit more into how we structured our pre-travel budget.

This is the Perfect Time to Teach your Kids About Money Management

We firmly believe it is never too early for your children to learn about managing money and travelling with them is a great opportunity to teach them about the power of budgeting.

Involve them in the process by explaining your priorities, the costs, and the compromises you make as you travel. You can also encourage them to keep a travel journal of their experiences to instil a sense of value and appreciation for the money spent. While away, encourage them to look at options available for transport and accommodation and ask them what they think is best to do.

When we travel we also set Georgia and Eva a weekly allowance for them to spend as they please. This lets them learn how to make choices with their money and appreciate value.

Managing Money Day to Day While you are Away

Setting a budget for travelling with children is one thing; sticking to it is quite another! Keeping a handle on spending while away is notoriously tricky. Be honest; how many times have you returned from a trip and been surprised at how much you have spent? We know we have!

From experience, two challenges make sticking to a budget while travelling tough. For us, the biggest problem is a strange mental block where spending foreign currency does not feel like we are spending ‘real’ money. In fact, the running joke in our family is that spending money abroad feels like spending Monopoly money.

Then there is the issue of dealing with exchange rates, so you know how much you have spent. Some currencies are straightforward to convert in your head; when we were in Australia it was two Dollarydoos to the British Pound, easy! When we were in Laos it was 17,801 Kip to the Pound, anything but easy!

So, how to tackle the above challenges?

Tracking Your Spending

This is one thing that technology has made so much easier! With online banking, real-time exchange tracking, and budgeting apps you have way more information and control at your fingertips.

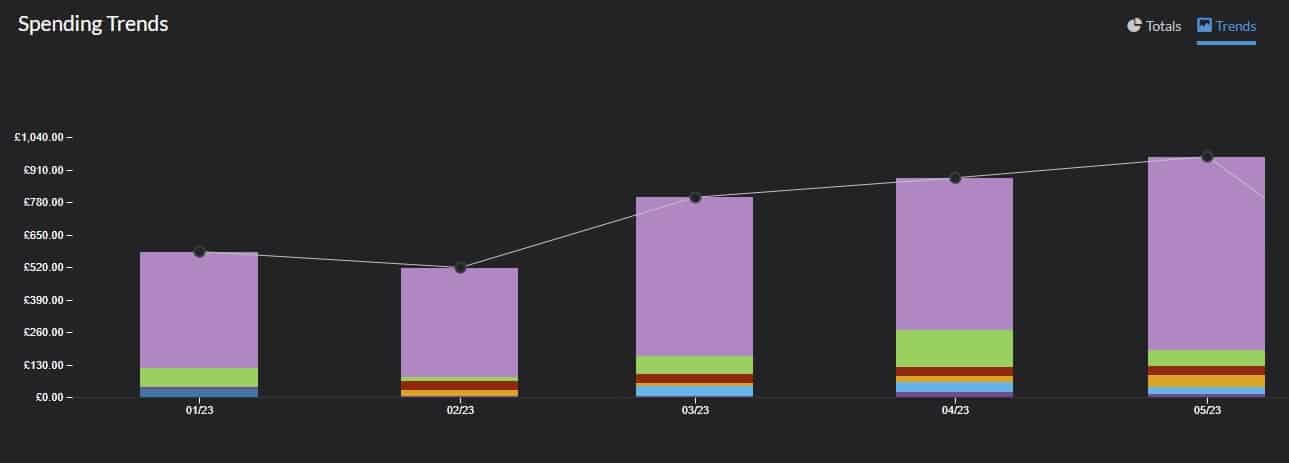

We have been using the brilliant You Need A Budget (YNAB) for years to track spending. It encourages you to plan your budget by assigning funds to categories and then tracking and splitting your spending into these categories. If used properly, it gives you real-time information not only on where your budget stands, but you can use the reporting tool to look back over previous weeks to see what your significant expenses have been. This gives a much clearer idea of where you can expect to spend money in the future.

You can also set up YNAB to sync transactions automatically from your bank account so you can make sure your budget matches reality. The only slight issue of YNAB is it doesn’t deal well with multiple currencies so when you enter items you have to guess what it will cost in your home currency and then correct it later once it has synced with your account.

Another advantage to tracking your spending means you will be quick to spot any unexplained charges that appear on your cards. More than once we found mysterious unauthorized fees after visiting various attractions that we were quickly able to reverse with the help of our bank.

For more tips on safely using your card abroad and avoiding some classic backpacking swindles, then have a look at: On the Road With Children: Safeguarding Against Travel Scams.

Dealing with Exchange Rates

This is a bit of an odd recommendation, but we swear by it. When you are working out what exchange rate to use for your mental calculations, work on the basis that the exchange rate is slightly worse than it actually is. For example, when we were in Italy it was about 1.1 Euros to the Pound, but we worked on a straight 1 to 1 conversion rate. This was easier to deal with and meant at the end of the day we had spent less money than we thought we had. Likewise, when we were in Laos dealing with the 17,801 Kip to the Pound we worked on a 15,000 to the Pound basis. This was much easier to convert as well mentally!

Beyond that, there is only the obvious suggestion of having a good currency converter app on your phone. We use “Easy Currency Converter” on Android, but there are many options that are basically the same.

Getting Bang for your Buck – Making the Most of Your Money

So, you have made a budget, got a handle on your spending, and know the favourable exchange rate. What pitfalls are there to avoid and how do you stretch your budget further? Happily, there are plenty of ideas and options that will make for great family adventures without overspending.

Prioritize What Is Important

While you are away there is a temptation to try and do and see everything, sadly unless you are travelling on an unlimited budget this is just not possible. We have made this mistake before and we were astonished at how quickly a couple of spontaneous excursions chewed through the budget. Sit down together as a family, work out what you all really want to do, and put that at the top of the list. Once you know your big goals and what they will cost, you are in a much better position to allocate the rest of your budget and resist temptation.

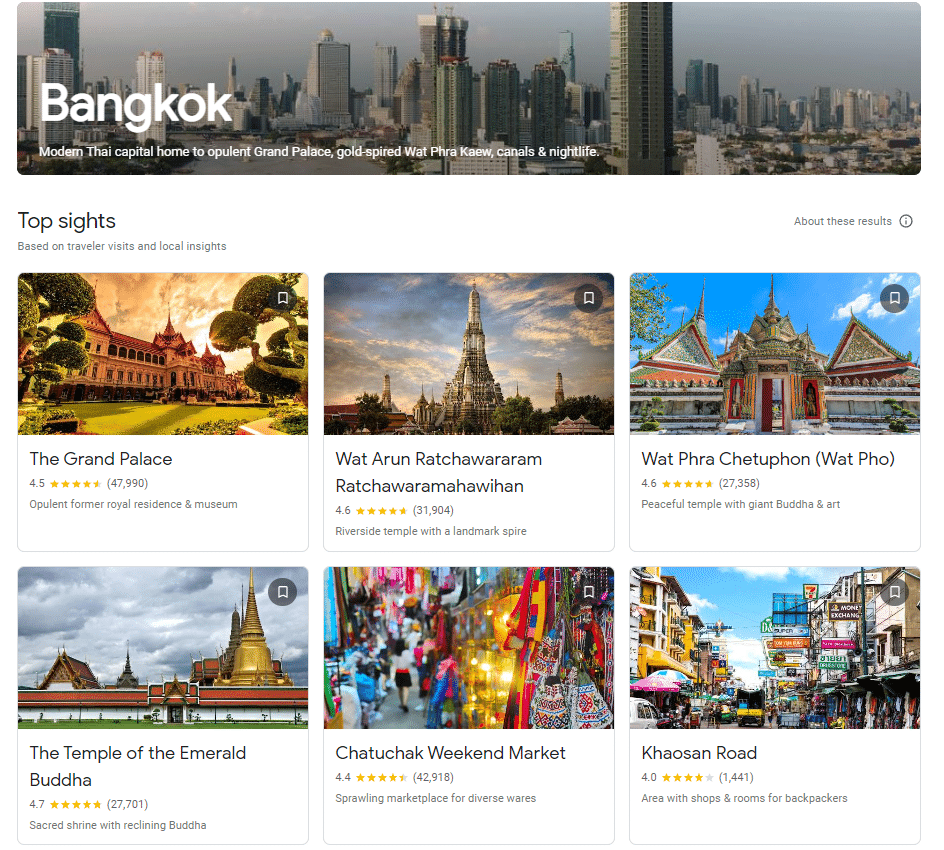

Look for Engaging, Cheap, Family-Friendly Attractions

While exploring new places there are nearly always educational destinations that cater to children’s interests. Cities especially offer free or low-cost attractions such as child-friendly walking tours, museums, art galleries, cultural events, botanical gardens and parks. There are loads of great tools that make finding these places easy, we use Google Travel and good old Trip Advisor as starting points to search.

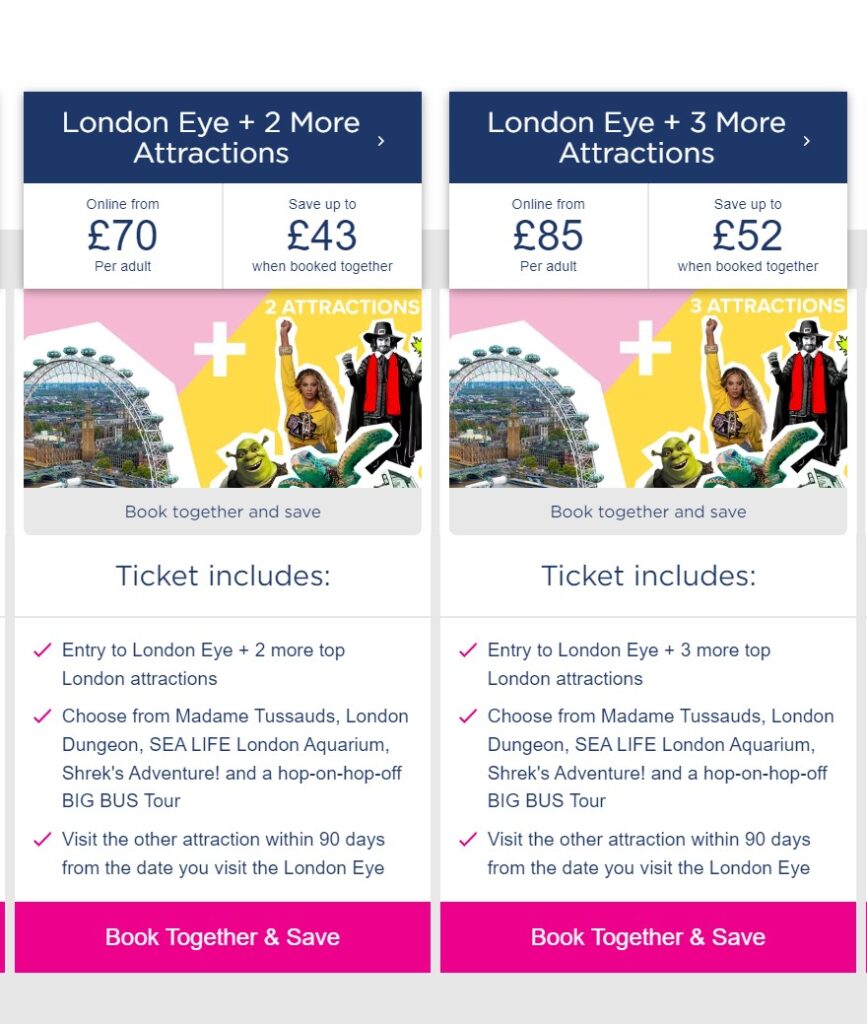

Keep an eye out for Family Deals

If you are looking to take the children to some paid attractions, many offer family discounts or sometimes you can gain access to multiple attractions on one ticket so be sure to keep an eye out for these deals. When we were in London we used a Multi Attraction Ticket which saved us over £150 as a family and we have used Similar things in Turkey & Italy.

Another option to consider is, if you can, grouping up with another family and booking a private tour to get a good rate and split the costs.

Beware Currency Conversion Traps

One expensive pitfall to avoid while you are away is being stung on currency conversion when you use your card. If a retailer or cash machine asks if you would like to pay in your home currency or the local currency, always choose the local currency. If you choose your home currency then the retailer sets the exchange rate and it is usually worse than the one set by your bank. This might only be a small amount for one transaction but will quickly mount up over a year away.

‘Make and Take’ Your Food

After sleeping and doing, eating is usually the biggest expense! To limit this, we try to ‘make and take’ our own rather than relying on hideously overpriced tourist cafes for meals and snacks. What you will be able to make depends on what facilities you have and if you can’t make anything then hunt down the nearest bakery or corner shop and stock up there. Finding bakeries while travelling has been a Spencer family favourite for years. Not only are they great value for money but you also get to discover local delicacies as well! Even if you can’t carry a meal, taking a suitable snack can hold the hunger for a while until you are out of the overpriced tourist trap areas.

To transport sandwiches and anything else we carry reusable silicone sandwich bags. These weigh next to nothing, are easy to clean and take up no space when packed away.

Make and take really is a win, win. It is cheaper, healthier, instantly available, and leads us nicely on to…..

Go Self-Catering

Using accommodation with kitchen facilities and fridges allows you to prepare meals and snacks yourself, reducing one of the biggest expenses of travelling: eating out.

Look for Cheaper, Less Touristy Alternatives to Famous Experiences or Places

There are often alternatives to many experiences that are just as good but quieter and cheaper. A great example of this are these Inca Trail Alternatives which are just as majestic but at a fraction of the cost.

Of course, some things are one-offs, there is only one Eiffel Tower for example, but by taking the time to look around you can find some big savings.

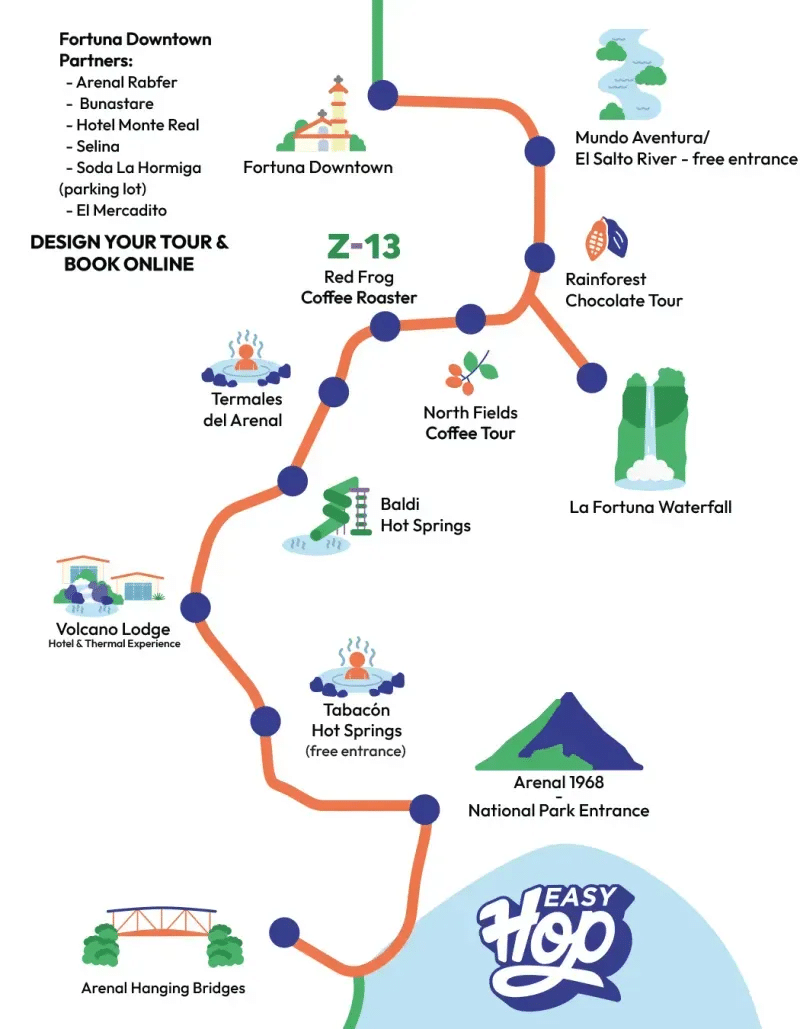

Where You Can, use Public Transport

Using public transport can be a massive saving over taxis (especially when getting to or from an airport!) or hiring a car but this is one of the areas where travelling with children can make it tricky to watch your budget. The temptation after a long day exploring a city and with two tired and grumpy children to contend with to just jump in a taxi rather than trying to navigate a labyrinthine bus network is totally understandable. If you are tempted, I would mention that in our experience Uber is about half the cost of a taxi in some places if available so have a look around. Many tourist areas also run cheap/free “hop on hop off” buses which can be very handy.

Watch Out for Airport Rip-Offs

Just about every time we have used an airport we have been ripped off in one way or another. From paying exorbitant amounts for a taxi to seemingly spontaneous taxes levied by chaps with Kalashnikov rifles it is part and parcel of the experience. Apparently, the befuddlement of navigating a foreign airport with children leaves you mentally incapable of defending yourself against such things. If you know how to avoid this, please tell us! Like the tides and the moon, we have just accepted being ripped off at airports as part of travelling.

So there we have it! All the pitfalls, planning tips and money-saving ideas we know in one place. If you have any suggestions or tips we have missed we would love to hear them so please leave us a comment below.